LIFO Method: Understanding Last-In, First-Out In Inventory

For investors, inventory can be one of the most important items to analyze because it can provide insight into what’s happening with a company’s core business. However, please note that if prices are decreasing, the opposite scenarios outlined above play out. In addition, many companies will state that they use the “lower of cost or market” when valuing inventory. This means that if inventory values were to plummet, their valuations would represent the market value (or replacement cost) instead of LIFO, FIFO, or average cost. To elect for the LIFO inventory accounting method, you must fill in and submit Form 970, along with your tax returns in the year you first implemented LIFO. With this cash flow assumption, the costs of the last items purchased or produced are the first to be counted as COGS.

- Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

- This article will cover how to determine ending inventory by LIFO after selling in contrast to the FIFO method, which you can discover in Omni’s FIFO calculator.

- This is because when using the LIFO method, a business realizes smaller profits and pays less taxes.

- When inventory balance consists of units with a different value, it is important to show those separately in the order of their purchase.

- LIFO, or Last In, First Out, is a common accounting method businesses can use to assign value to their inventory.

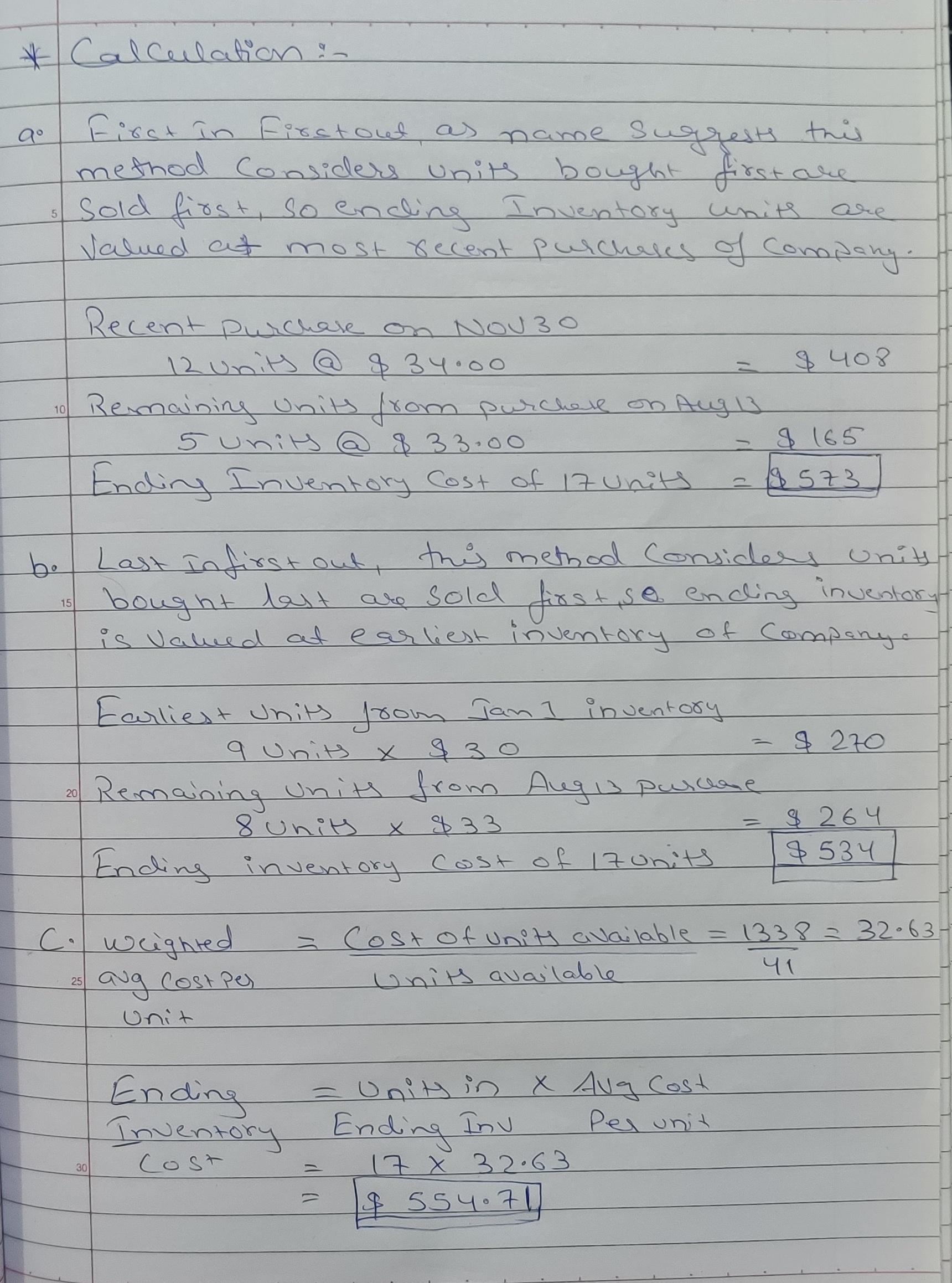

How To Calculate FIFO

The last-in, first-out method is an inventory cost flow assumption allowed in by US GAAP and income tax laws. The LIFO method proponents argue that the LIFO method improves the matching of revenues and replacement costs. However, the cost of ending inventory presented in the balance sheet presents older costs. More importantly, users of the LIFO method say that using LIFO gives them tax savings since they report a lower taxable income.

Comparing Perpetual LIFO and Periodic LIFO

However, for accounting purposes, as long as you remove COGS from the last inventory replenishment cycle under LIFO, it (technically) doesn’t matter if you sell the oldest or latest inventory items first. Auto dealerships often store their most recently acquired vehicles on their lots, and these vehicles are more likely to be sold first. Similarly, retailers dealing with items such as clothing, electronics, or snowmobiles often follow the LIFO method, as these products tend to lose value or become obsolete over time. However, it is important to note that the LIFO method is not permitted by the International Financial Reporting Standards (IFRS).

Lower Tax Liability

However, this results in higher tax liabilities and potentially higher future write-offs if that inventory becomes obsolete. In general, for companies trying to better match their sales with the actual movement of product, FIFO might be a better way to depict the movement of inventory. The average cost method takes the weighted average of all units available for sale during the accounting period and then uses that average cost to determine the value of COGS and ending inventory. In our bakery example, the average cost for inventory would be $1.125 per unit, calculated as [(200 x $1) + (200 x $1.25)]/400. In the world of accounting and finance, inventory valuation plays a crucial role in determining the cost of goods sold and the overall profitability of a business. There are several methods to value inventory, including the Last In, First Out (LIFO), First In, First Out (FIFO), average cost method, and specific identification.

The difference between perpetual LIFO and periodic LIFO

In the USA, companies prefer to use LIFO because it can help them reduce their taxable income. Furthermore, when USA companies have operations outside their country of origin, they present a section where the overseas inventory registered by FIFO is modified to LIFO. You can also check FIFO and LIFO calculators at the Omni Calculator website to learn what happens in inflationary/deflationary environments. Learn more about the advantages and downsides of LIFO, as well as the types of businesses that use LIFO, with frequently asked questions about the LIFO accounting method.

Outsource fulfillment to ShipBob and simplify the inventory management process.Request pricing to get started. As per LIFO, the business dispatches 25 units from Batch 3 (the newest inventory) to the customer. Recently, Jordan purchased 20 sofas at $1,500 each and six months later, another 20 units of the same sofa at $1,700 each. When using the perpetual system, the Inventory account q4dq why are sunk costs irrelevant is constantly (or perpetually) changing. Compare and contrast LIFO with FIFO, providing insights into factors that influence the choice between the two methods for businesses. It’s crucial to remember that adopting LIFO method has tax implications and should be carefully considered in consultation with your accountant to make sure it supports your overall business objectives.

LIFO is an inventory management system in which the items most recently added to a company’s stock are the first ones to be sold or used. In summary, choosing principles of accounting that can guide both financial reporting and tax strategy is an important management decision. During 2018, inventory quantities were reduced, resulting in the liquidation of certain LIFO inventory layers carried at costs that were lower than the cost of current purchases. Although using the LIFO method will cut into his profit, it also means that Lee will get a tax break. The 220 lamps Lee has not yet sold would still be considered inventory, and their value would be based on the prices not yet used in the calculation.

Using the newest goods means that your cost of goods sold is closer to market value than if you were using older inventory items. When reviewing financial statements, this can help offer a clear view of how your current revenue relates to your current spending. In periods of deflation, LIFO creates lower costs and increases net income, which also increases taxable income. Last in, first out (LIFO) is only used in the United States where any of the three inventory-costing methods can be used under generally accepted accounting principles (GAAP). The International Financial Reporting Standards (IFRS), which is used in most countries, forbids the use of the LIFO method.

233 total views, 4 views today