What Is The FIFO Method? FIFO Inventory Guide

The FIFO method is a practical approach that identifies the costs of the products you sell, at the point of sale. How you evaluate inventory can have major implications on your profitability. But in some countries, only one inventory valuation strategy is permitted by law. For example, the seafood company, mentioned earlier, would use their oldest inventory first (or first in) in selling and shipping their products. Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company’s process of using the oldest inventory first in selling their goods. The average inventory method usually lands between the LIFO and FIFO method.

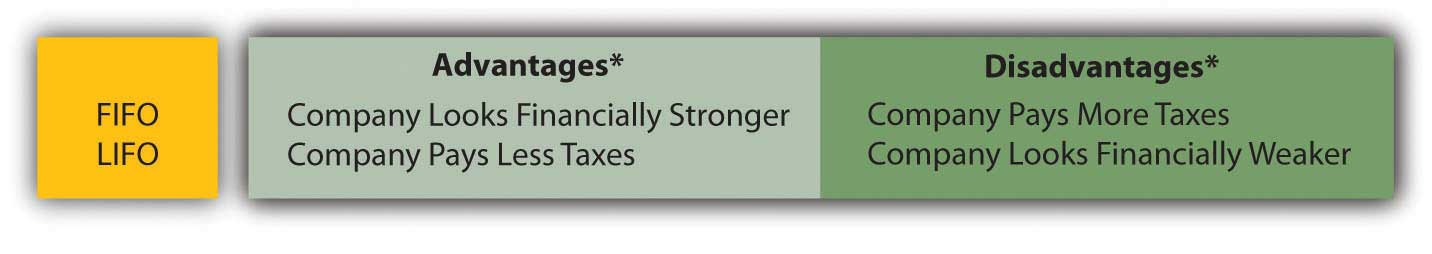

Benefits and Advantages of Using FIFO

It constantly brings you tax savings that can be reinvested back into your business. The FIFO method allows you to easily apply it through the management of inventory costs using and recording your most recent purchases or productions in the order they occur. LIFO assumes that the cost of inventory increases over time, with the most recently acquired stock costing more than earlier purchases.

FIFO Inventory Method

By considering the cost of the oldest batch of materials first, manufacturers can prevent material waste, reduce inventory holding costs, and maintain quality within their production processes. This accurate cost calculation allows businesses to optimize their pricing strategies and maximize profitability. Overall, the FIFO system has helped you run your warehouse efficiently, effectively, and has provided financial benefits as well.

- On the other hand, if the warehouse is storing non-perishable products without expiration dates, either system could potentially be used depending on the specific needs of the business.

- Not only does FIFO prevent materials from going unused or degrading, it also reduces waste and losses—not to mention storage costs.

- As mentioned previously, FIFO reflects the true cost of inventory because it can be accurately represented in financial statements.

- In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive.

- The difference between FIFO and LIFO is that the LIFO method sells or uses the oldest inventory first while the FIFO method sells or uses the newest inventory first.

What Is FIFO Inventory Method?

These can include the complexity of the inventory system, the level of staff training required, and the potential impact on customer satisfaction. It is important for warehouse owners and operators to carefully evaluate these and other factors when deciding which inventory management system is the best fit for their business. By ensuring that the oldest products are sold first, FIFO allows businesses to make quick adjustments to their inventory levels in order to meet customer demand. When using the FIFO system, new items are added to the back of the inventory, while the oldest items are taken from the front of the inventory to be sold or used first. In this way, FIFO ensures that the oldest items are always sold or used before newer items in order to avoid any potential losses from expiration or price changes.

This calculation method typically results in a higher net income being recorded for the business. The FIFO method is the first in, first out way of dealing with and assigning value to inventory. It what is a perpetual inventory system definition and advantages is simple—the products or assets that were produced or acquired first are sold or used first. With FIFO, it is assumed that the cost of inventory that was purchased first will be recognized first.

Under the LIFO method, assuming a period of rising prices, the most expensive items are sold. This means the value of inventory is minimized and the value of cost of goods sold is increased. This means taxable net income is lower under the LIFO method and the resulting tax liability is lower under the LIFO method. When sales are recorded using the FIFO method, the oldest inventory–that was acquired first–is used up first.

Whereas in LIFO accounting which stands for last in, first out, the most recent items that enter the inventory are the first ones that are sold. By tracking each item’s entry and exit date, businesses can get a clearer understanding of which products they need to restock in order to meet customer demand. This can help them stay ahead of the competition and ensure that their customers’ needs are being met. However, FIFO can be used in any industry where product demand or prices may fluctuate.

Since FIFO assigns the oldest costs to COGS, the reported costs may not reflect the current market conditions, potentially distorting profitability and financial ratios. FIFO is a widely used method to account for the cost of inventory in your accounting system. It can also refer to the method of inventory flow within your warehouse or retail store, and each is used hand in hand to manage your inventory. The FIFO method is especially critical for pharmaceutical companies dealing with drugs and medications. To comply with regulatory requirements and ensure patient safety, pharmaceutical manufacturers and distributors need to prioritize the sale of drugs based on their expiration dates.

The older inventory, therefore, is left over at the end of the accounting period. For the 200 loaves sold on Wednesday, the same bakery would assign $1.25 per loaf to COGS, while the remaining $1 loaves would be used to calculate the value of inventory at the end of the period. Spreadsheets and accounting software are limited in functionality and result in wasted administrative time when tracking and managing your inventory costs. Often compared, FIFO and LIFO (last in, first out) are inventory accounting methods that work in opposite ways.

We will also provide detailed examples to illustrate its implementation across different industries. By the end of this guide, you will have a solid understanding of the FIFO method and how it can optimize your inventory management processes. Welcome to our comprehensive guide on the FIFO (First In, First Out) method in inventory management.

136 total views, 8 views today