Variable Cost: What It Is and How to Calculate It

Fixed costs are expenses that do not vary with the level of production or business activities, such as rent, web hosting, and utility bills. These costs need to be managed to improve the overall financial health of a business. Understanding and managing are direct materials variable costs variable costs have a profound impact on business decisions. These costs, which fluctuate in direct proportion to the volume of units produced, can shape strategies related to scaling operations, optimizing resources, and investing in new technology.

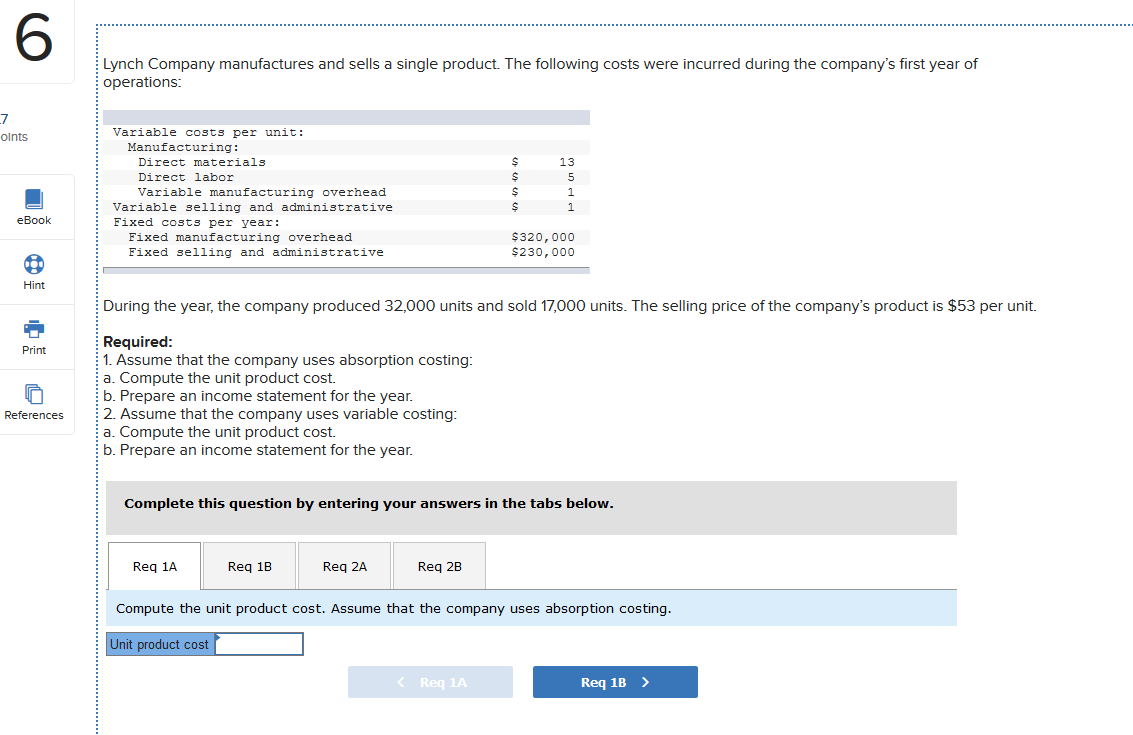

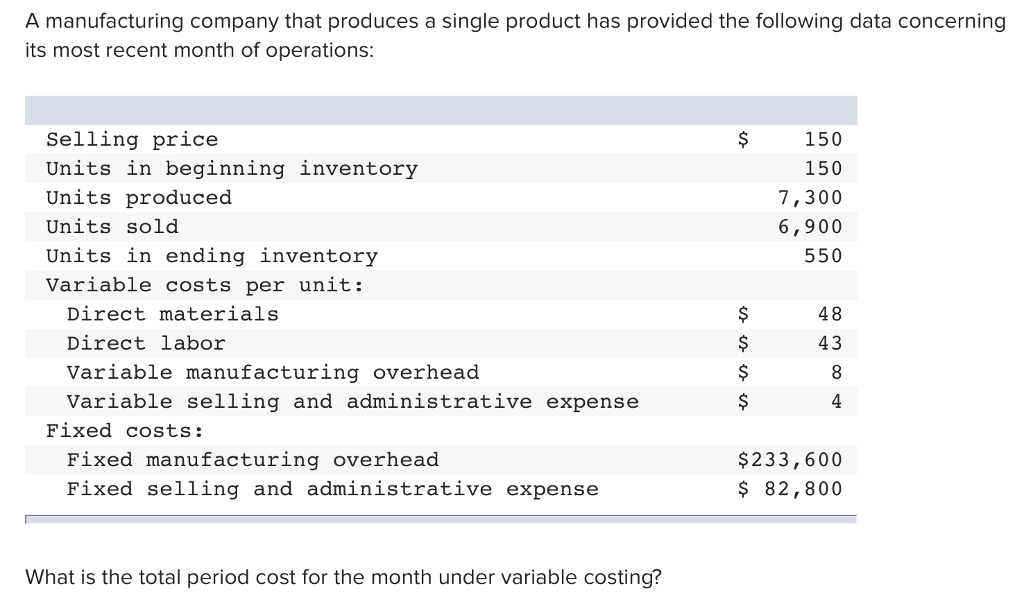

- Therefore, total variable costs can be calculated by multiplying the total quantity of output by the unit variable cost.

- For some businesses, overhead may make up 90% of monthly expenses, and variable 10%.

- Examples of variable costs include raw materials, direct labor wages, and manufacturing supplies.

- However, if you pay commissions for every unit sold on top of a salary, they would be variable costs.

In what ways do variable costs impact a company’s breakeven point?

These additional costs, however, could be offset by the potential benefits CSR initiatives may bring in terms of enhanced reputation, increased customer loyalty, and potential for market expansion. Direct materials are those materials and supplies that are consumed during the manufacture of a product, and which are directly identified with that product. Items designated as direct materials are usually listed in the bill of materials file for a product. The bill of materials itemizes the unit quantities and standard costs of all materials used in a product, and may also include an overhead allocation.

Optimizing Fixed Costs

One of the primary features of variable costs is their direct relationship with the level of production or business activity. In simple terms, variable costs increase when production levels go up and decrease when production levels go down. Direct material cost is the cost of the raw materials and components used to create a product.

Comparing Fixed and Variable Costs

If companies ramp up production to meet demand, their variable costs will increase as well. If these costs increase at a rate that exceeds the profits generated from new units produced, it may not make sense to expand. A company in such a case will need to evaluate why it cannot achieve economies of scale. In economies of scale, variable costs as a percentage of overall cost per unit decrease as the scale of production ramps up. These expenses change in proportion to the level of production or sales, making them an important factor in business decision-making.

However, the cost of electricity is a variable cost since electricity usage increases with the number of products that are produced or manufactured. Direct costs do not need to be fixed in nature, as their unit cost may change over time or depending on the quantity being utilized. This cost may be directly attributed to the project and relates to a fixed dollar amount.

In the world of financial analysis and performance, understanding fixed and variable costs is essential for effective decision-making. Businesses must monitor and control these costs to maintain profitability and meet the expectations of investors. When managing a business, understanding fixed and variable costs is crucial for proper accounting and financial decision-making.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This might involve training employees, investing in advanced machinery, or adopting new production techniques. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Over a one-day horizon, a factory’s costs might largely consist of fixed costs, not variable. The company must pay for the building, the employee benefits, and the machinery regardless of whether anything is produced that day. The main variable cost will be materials and any energy costs actually used in production. However, over a six-month horizon, the factory will be better able to change the amount of labor to fit the desired output, either by using overtime hours, laying off employees, or hiring new employees.

Thus, which costs are classified as variable and which as fixed depends on the time horizon, most simply classified into short run and long run, but really with an entire range of time horizons. Balancing these strategies while addressing complexities in cost identification ensures businesses make informed choices, optimizing their performance and sustaining success. Lean management focuses on eliminating waste in all forms from the production process. Variable costs are usually viewed as short-term costs as they can be adjusted quickly.

Variable costs are expenses that fluctuate in direct proportion to the volume of goods or services that a business produces. For instance, if a company manufactures more products, it may need more raw materials, leading to increased costs. Variable expenses are calculated by first calculating the variable cost per unit—what it costs to produce a single unit in expenses such as labor and materials. You then multiply this by the total number of units produced to calculate your total variable costs for the production of that particular product.

128 total views, 4 views today