Mastering Full Charge Bookkeeping: A Comprehensive Guide for Beginner, Intermediate & Advanced Bookkeepers

However, as your business appetites grow and your company scales, you might ask yourself whether this role should be taken to a higher level as well. ” question and explain the job’s duties, responsibilities, educational requirements, and more. If you’re just starting out with your small business, you’ll probably be satisfied with the services of a regular bookkeeper. They’ll be in charge of getting your finances organized, keeping track of sales, income and expenses, and executing payrolls.

How Does Full Charge Bookkeeping Differ from Traditional Bookkeeping?

As a full charge bookkeeper, there are several essential skills that you need to possess in order to effectively perform your duties. These not only contribute to your success in the role but also ensure that you can provide accurate financial information and support to the business you work for. Let’s take a closer look at the key skills required for a full charge bookkeeper. Generating accurate and timely financial statements is vital for decision-making, financial planning, and complying with legal and regulatory requirements. It requires a https://www.bookstime.com/ strong understanding of accounting principles, attention to detail, and proficiency in accounting software. Discover how outsourced bookkeeping services can streamline your financial management, enhance accuracy, and save costs for your business.

Increasing Demand in Small Businesses

- Instead of spending hours on bookkeeping tasks, you can dedicate your energy to growing your business, serving your customers, and developing new strategies.

- This includes recording financial transactions, reconciling accounts, and preparing financial statements.

- These distinctions become apparent when we delve into their responsibilities, education, and contribution to strategic decision-making.

- At Future Proof Accounting, we’re not just your bookkeepers – we’re your partners in prosperity.

- By leveraging the functionalities of accounting software, you can save time, reduce errors, and provide timely and insightful financial information to management.

As these businesses grow and expand, the need for professional bookkeeping services becomes more evident. While education lays the foundation, gaining practical experience is crucial for becoming a successful full charge bookkeeper. Practical experience allows you to apply your knowledge in real-world scenarios net sales and develop the necessary skills to handle the of the role effectively.

Role in Small Business Bookkeeping

- Becoming a full charge bookkeeper requires a combination of education, practical experience, and professional certifications.

- Attention to detail helps you identify discrepancies, reconcile accounts, and avoid costly mistakes.

- Larger companies sometimes have the assistance of an outside certified public accountant to review and audit more complicated financial statements and tax returns.

- In summary, a full charge bookkeeper and a regular bookkeeper differ in terms of their scope of work, level of autonomy, and salary.

- They are usually involved in more complex financial planning, including tax planning and business analysis.

- We provide professional accounting services to businesses and individuals, with a focus on small business bookkeeping and taxes.

Since it is the largest expense for most companies, employers Bookkeeping for Any Business Industry need to think strategically about work roles. Full charge bookkeeping is a skillset that drives a variety of financial responsibilities. We explain why this is a viable option for businesses just starting out, or looking to expand the accounting department.

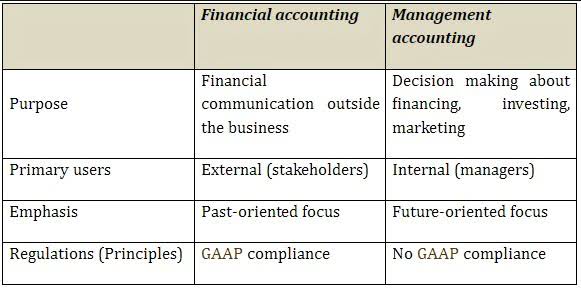

These duties include managing accounts receivable, handling accounts payable, reconciling bank statements, and generating financial statements. Let’s take a closer look at each of these tasks and the importance they hold in maintaining accurate and organized financial records. A full charge bookkeeper and a regular bookkeeper may seem similar at first glance, but they have distinct differences in terms of their scope of work. A full charge bookkeeper is responsible for managing all aspects of a company’s financial records, from recording transactions to generating financial statements. They handle everything from accounts payable and accounts receivable to payroll and tax preparation. In contrast, a regular bookkeeper typically focuses on specific areas of financial management and may not have the same level of responsibility or authority.

88 total views, 4 views today