Fixed Overhead Volume Variance Definition, Formula, Example

Fixed overhead volume variance occurs when the actual production volume differs from the budgeted production. In this way, it measures whether or not the fixed production resources have been efficiently utilized. Being fixed within a certain range of activity, fixed overhead costs are relatively easy to predict. Because of the simplicity of prediction, some companies create a fixed overhead allocation rate that they continue to use throughout the year.

Calculating the Fixed Overhead Allocation Rate

By integrating this variance into financial reports, analysts can provide a comprehensive overview of how effectively a company is leveraging its production capacity. Fixed overhead efficiency variance is the difference between the number of hours that actual production should have taken, and the number of hours actually taken (that is, worked) multiplied by the standard absorption rate per hour. Fixed Overhead Efficiency Variance calculates the variation in absorbed fixed production overheads attributable to the change in the manufacturing efficiency during a period (i.e. manufacturing hours being higher or lower than standard ). The fixed overhead costs that are a part of this variance are usually comprised of only those fixed costs incurred in the production process. Examples of fixed overhead costs are factory rent, equipment depreciation, the salaries of production supervisors and support staff, the insurance on production facilities, and utilities.

Fixed Manufacturing Overhead: Standard Cost, Budget Variance, Volume Variance

The credit balance on the fixed overhead budget variance account (2,000), has now been split between the work in process inventory account (600) and the cost of goods sold account (1,400) decreasing both accounts by the appropriate amount. The debit balance on the fixed overhead volume variance account (1,040) has been charged to the cost of goods sold account, and both variance account balances have been cleared. The fixed manufacturing overhead volume variance is the difference between the amount of fixed manufacturing overhead budgeted to the amount that was applied to (or absorbed by) the good output. If the amount applied is less than the amount budgeted, there is an unfavorable volume variance. This means there was not enough good output to absorb the budgeted amount of fixed manufacturing overhead. If the amount applied to the good output is greater than the budgeted amount of fixed manufacturing overhead, the fixed manufacturing overhead volume variance is favorable.

Formula:

This implies that the difference between budgeted and flexed fixed cost is included twice in the operating statement. Similarly, if the allocated volume is down to the number of machine hours and a company outsources some or all of its production, the budgeted amount of machine hours will be much less than expected. This variance would be posted as a credit to the fixed overhead budget variance account. In a standard costing accounting system, the fixed overhead variance is the difference between the standard fixed overhead and the actual fixed overhead. This result of $950 of unfavorable fixed overhead volume variance can be used together with the fixed overhead budget variance to determine the total fixed overhead variance.

- By contrast, efficiency variance measures efficiency in the use of the factory (e.g., machine hours employed in costing overheads to the products).

- If sales on a product are seasonal, production volumes on a monthly basis can fluctuate.

- Total overhead cost variance can be subdivided into budget or spending variance and efficiency variance.

- This allocation rate is the expected monthly amount of fixed overhead costs, divided by the number of units produced (or some similar measure of activity level).

- Factory overhead costs are also analyzed for variances from standards, but the process is a bit different than for direct materials or direct labor.

Fixed Manufacturing Overhead Volume Variance quantifies the difference between budgeted and absorbed fixed production overheads. Interpreting volume variance results requires a nuanced approach, as these figures can be indicative of broader operational dynamics. When a company observes a variance from its expected fixed overhead, it’s not merely looking at a discrepancy in numbers but also at underlying factors that may include shifts in market conditions or internal process changes.

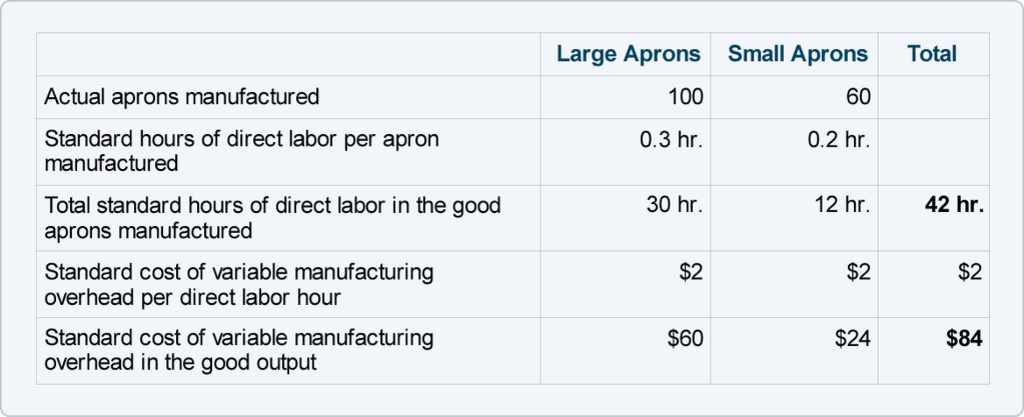

To operate a standard costing system and allocate fixed overhead, the business must first decide on the basis of allocation. Various methods can be used to allocate the fixed overhead including for example, the number of direct labor hours used in production or the number of machine hours used. We begin by determining the fixed manufacturing overhead applied to (or absorbed by) the good output what are state tax forms produced in the year 2023. Recall that we apply the overhead costs to the aprons by using the standard amount of direct labor hours. A simple way to assign or allocate the fixed costs is to base it on things such as direct labor hours, machine hours, or pounds of direct material. Accountants realize that this is simplistic; they know that overhead costs are caused by many different factors.

Fixed overhead represents all items of expenditure which are more or less remain constant irrespective of the level of output or the number of hours worked. An income statement that includes variances is very useful for managers to see how deviations from budgeted amounts impact gross profit and net income. These insights help in planning by addressing reasons for unfavorable variances and continuing with line items that are favorable. Strategic planning also involves considering the workforce implications of volume variance. This variance arises due to the difference in the number of working days when the actual number of working days is greater than standard working days. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

A portion of these fixed manufacturing overhead costs must be allocated to each apron produced. This is known as absorption costing and it explains why some accountants say that each product must “absorb” a portion of the fixed manufacturing overhead costs. Understanding the nuances of financial metrics is crucial for businesses to navigate their fiscal landscape effectively. Fixed overhead volume variance stands out as a pivotal element in this regard, offering insights into operational efficiency and cost management. This metric serves as a barometer for assessing how well a company utilizes its production capacity relative to its fixed costs. The standard fixed overhead applied to units exceeding the budgeted quantity represent cost saved because units were essentially produced at no additional fixed overhead.

This is a cost that is not directly related to output; it is a general time-related cost. Specifically, fixed overhead variance is defined as the difference between Standard Cost and fixed overhead allowed for the actual output achieved and the actual fixed overhead cost incurred. Fixed Overhead Capacity Variance calculates the variation in absorbed fixed production overheads attributable to the change in the number of manufacturing hours (i.e. labor hours or machine hours) as compared to the budget. Changes in market demand can lead to fluctuations in production volume, thereby affecting the variance. Production inefficiencies, such as machine breakdowns or labor disputes, can also result in lower output than planned. Additionally, strategic decisions, like the introduction of new products or changes in product mix, can alter production volumes and impact the variance.

The fixed overhead volume variance is also one of the main standard costing variances, and is the difference between the standard fixed overhead allocated to production and the budgeted fixed overhead. An unfavorable fixed overhead volume variance occurs when the fixed overhead applied to good units produced falls short of the total budged fixed overhead for the period. If the actual production volume is higher than the budgeted production, the fixed overhead volume variance is favorable. On the other hand, if the actual production volume is lower than the budgeted one, the variance is unfavorable. The calculation of the sub-variances also doesn’t provide a meaningful analysis of fixed production overheads. For example, if the workforce utilized fewer manufacturing hours during a period than the standard, it is hard to imagine a significant benefit of calculating a favorable fixed overhead efficiency variance.

For instance, a positive variance often prompts a review of market engagement strategies, as it may suggest that the company’s products are not meeting market demand as anticipated. Controlling overhead costs is more difficult and complex than controlling direct materials and direct labor costs. In the standard costing system, the fixed overhead is posted at the standard cost of 11,960, represented by the debit to the work in process inventory account. Initially the actual fixed overhead expense (rent etc) would have been posted to the expense account with the usual entry of debit expense, credit accounts payable (not shown). The journal above now allocates some of this expense (11,000) to production, this is represented by the credit entry to the expense account.

260 total views