Contractor Bookkeeping Services For Massachusetts

The Forbes https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey. FOUNDATION offers user-friendly job costing and is known for its streamlined workflows.

- Finally, you want to find a solution that you can customize if you have special reporting or processing needs.

- Keep track of deductible expenses, such as equipment depreciation, and ensure taxes are filed on time to avoid penalties.

- They also provide real-time insights into project finances, enabling proactive adjustments when necessary.

- Each job often requires separate tracking for expenses, labor costs, and timelines; tracking each project is essential.

- Effective Construction Bookkeeping Services ensures that all project-related expenses, such as materials, labor, and subcontractor fees, are accurately recorded.

Sage Intacct Construction and Sage Intacct Real Estate

Some of it is likely reserved for things like payroll, covering expenses, and paying taxes. Keeping all your company’s money in a single bank account makes it harder to understand how you’re doing financially because all the money in the bank account might not necessarily be yours. It allows you to estimate labor, material, and overhead cost, as well as determine how much you should charge for the project. You need to record both direct and indirect costs if you want to track and spend efficiently.

Accounting and Tax Services for the Construction Industry

Their responsibilities differ significantly from standard bookkeeping, as they need to account for project-specific variables like labor, materials, and job costing. This guide covers key aspects of construction bookkeeping, including the role of a construction bookkeeper, recording expenses, and industry-specific accounting methods. By mastering these practices, construction companies can gain better control of their financial performance and reduce inefficiencies in managing costs.

- Payroll integration, so you can pay employees and subcontractors with ease, while staying compliant with tax regulations.

- While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe.

- Integration with QuickBooks, ensuring seamless synchronization of project costs with accounting records.

- Whether through cloud-based systems or personalized support, professional construction bookkeeping simplifies operations and drives profitability.

- Expensify is a software solution designed to help businesses track, organize, and categorize receipts and expenses.

What’s the Most Recommended Construction Accounting Software in Massachusetts?

While many contractors manage their finances, it’s always advisable to seek professional assistance when needed. Professional construction bookkeeping services can offer expert guidance, ensuring that your finances are in order, taxes are managed efficiently, and business growth is well-supported. In construction, cash flow management is often challenging due to project-based billing and delayed payments. Effective cash flow management helps firms cover ongoing expenses, including payroll and material costs, even when clients are late on payments. A construction bookkeeper plays a vital role in managing financial data for construction projects.

Seek Professional Help When Needed:

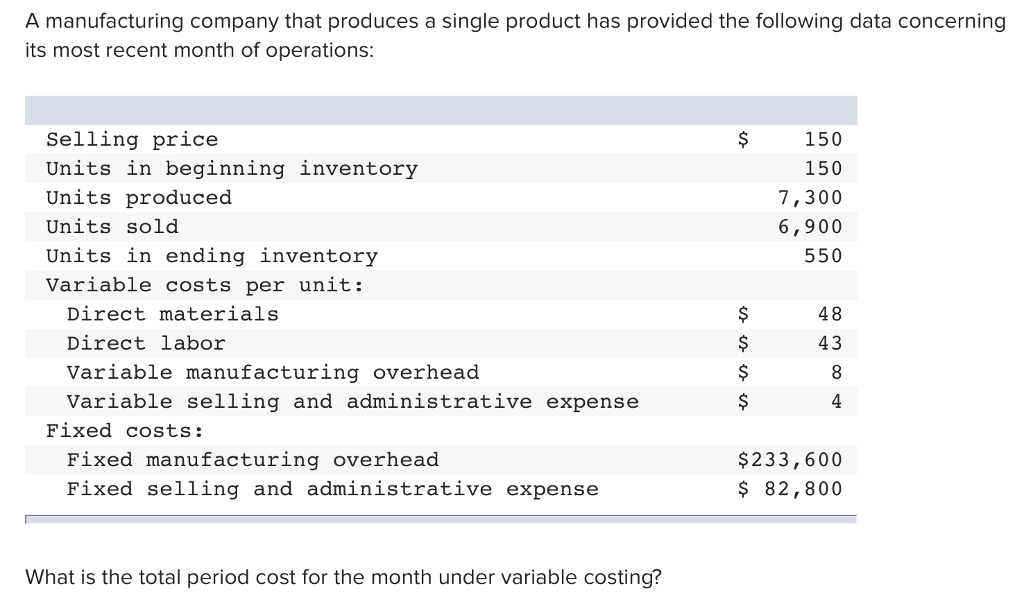

Failing to track all expenses related to individual projects, including materials, labor, subcontractors, and overhead costs, can result in inaccurate financial reports. Proper job costing ensures that each project’s true profitability is understood and helps prevent cost overruns. Residential construction includes single-family homes, multi-family units, and townhouses. The primary bookkeeping challenge in residential Construction Bookkeeping Services is accurately tracking costs related to materials, labor, and permits. Since these projects are often smaller, maintaining detailed job costing and tracking payments from homeowners is essential for managing cash flow and ensuring profitability. Implementing the best construction bookkeeping methods allows building ventures to normalize their financial situation and achieve long-term sustainability.

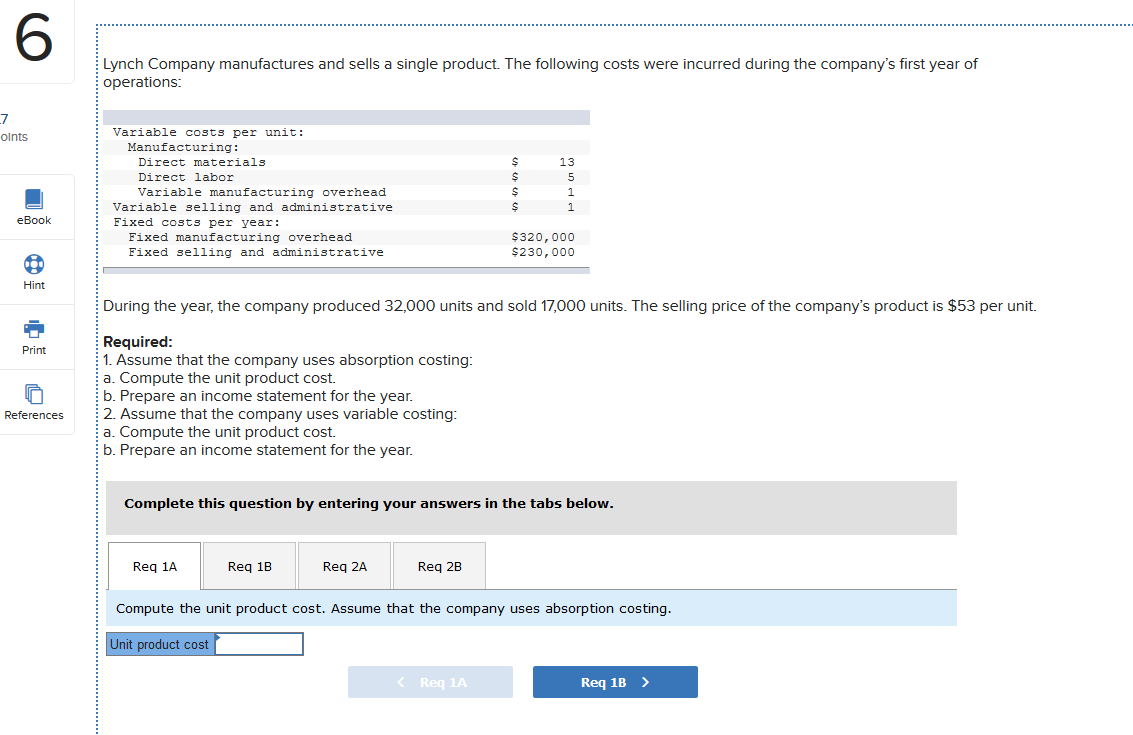

#1 – Do you feel like the picture below when you are working on QuickBooks?

- Manual job costing can be very time-intensive, especially when it comes to complex projects.

- Construction bookkeeping services help manage complex tax obligations, including sales tax, contractor-specific taxes, and payroll taxes.

- Mixing business and personal funds can lead to errors in financial reporting and tax filing.

- Alternatively, you can talk with other business owners and ask if they can recommend a certified accountant.

Massachusetts is home to several large construction projects that are excellent opportunities for contractors to take advantage of. Ready to take control of your job costing and build a thriving construction business in Massachusetts? But one of the often-overlooked aspects of scaling your business is construction software. Relying on spreadsheets can make it difficult to accurately track your construction project financials and grow your business. Achieving transparency requires a firm to streamline its processes and prepare immaculate reports to win the trust of stakeholders. Project-based accounting empowers ventures to meet tight deadlines and follow the industry’s requirements, which leads to revenue increases.

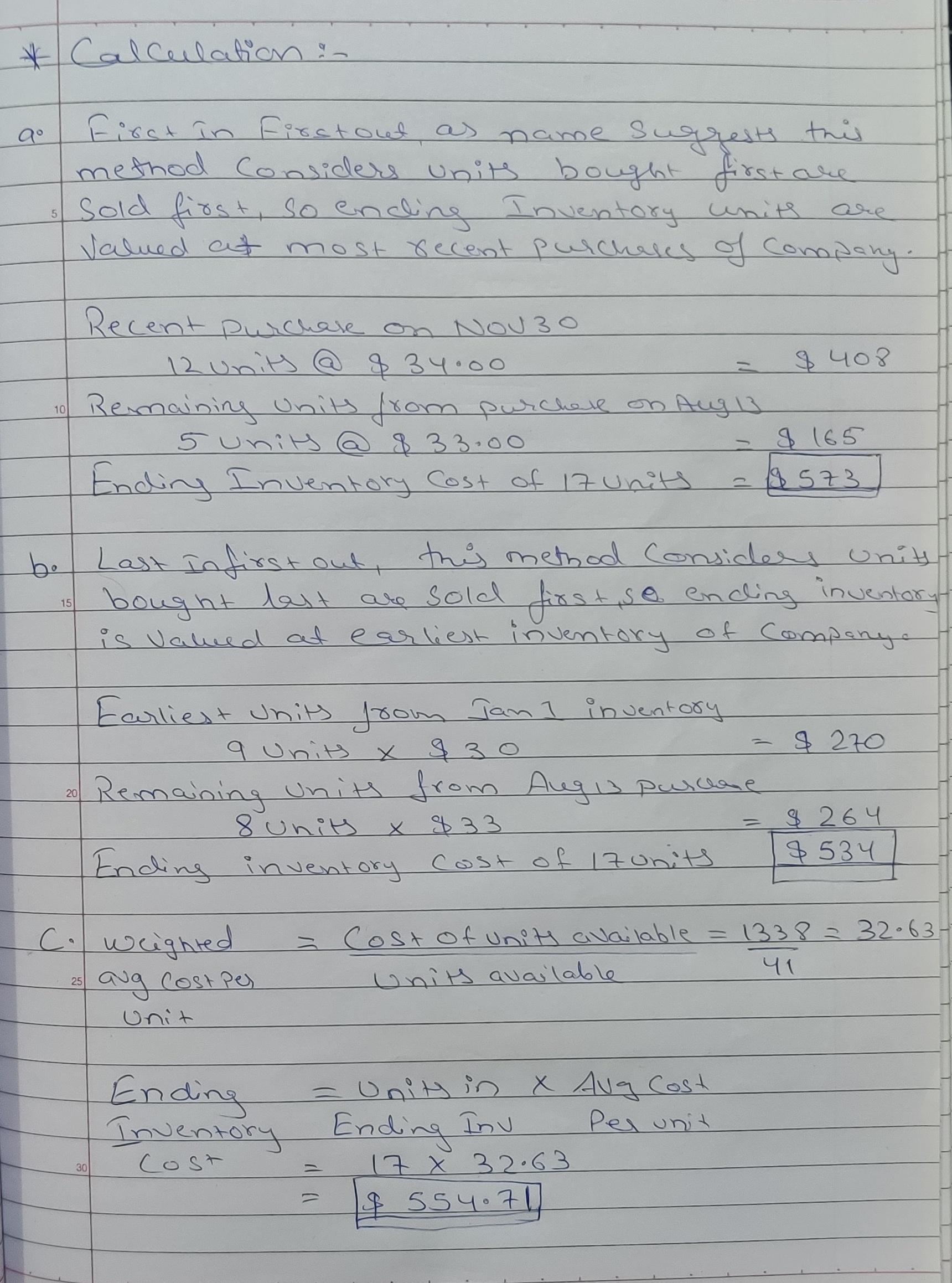

How do you do construction accounting?

Expert Construction Bookkeeping Services provide comprehensive financial reports that go beyond just profit and loss statements. Reports such as cash flow forecasts, balance sheets, and job costing summaries offer insights into where the business is excelling and where there may be financial risks. With accurate and real-time financial data at your fingertips, you can make smarter decisions about business expansion, hiring, investment opportunities, and cost-cutting strategies. This enables you to make proactive changes, ensuring that your growth is sustainable and profitable. Cash flow management is vital in the construction industry, especially as you take on larger projects or multiple jobs.

Step 2: Implement Percentage of Completion for Revenue Recognition

The cost management component factors in labor and equipment costs along with needed materials and subcontractor bids. You’ll be able to get into the weeds with budget management tools that allow you to go from budget to change order requests instantly. Bookkeeping for a construction company in Massachusetts requires intimate knowledge of the fluidity of how numbers can change from job to job. Our construction accounts payable software improves efficiency, cash flow management, and financial control for construction firms managing complex AP workflows. The significance of bookkeeping for construction companies lies in the fact such services enable them to diminish their expenditure and foster financial stability.

How to choose the right construction bookkeeping software

The best accounting method depends on your business size, project types, and financial goals. Many construction companies use the percentage-of-completion method for The Role of Construction Bookkeeping in Improving Business Efficiency long-term projects, as it provides a more accurate picture of financial performance over time. However, smaller companies or those with shorter projects may prefer the completed contract method for its simplicity.

99 total views